Hire Virtual Bookkeeping Assistants

Clean Books. Clear Focus.

Smarter Growth.

Doing your own books is like driving with your eyes half-closed.

Sure, you’re moving, but you don’t really know where the money’s going or what it’s costing you.

At Simpalm, we help you stop guessing and start scaling with vetted Bookkeeping Virtual Assistants who own your numbers, so you don’t have to. Whether you’re running a medical practice, law firm, eCommerce brand, or consultancy, your time is too valuable to spend sorting receipts at midnight.

Do You Really Need a

Remote Bookkeeper?

Maybe Not (Yet), If You

- Have fewer than 15 transactions/month

- Are pre-revenue or in the idea stage

- Use Stripe/Square + Excel or Notion, and don’t mind doing it yourself

- Have no employees, payroll, or vendors

- File your own taxes and haven’t had any late fees, penalties, or surprises

- Your finances are clean, current, and not stressing you out

You’re lean, organized, and DIY works for now.

Just keep an eye on your time and revisit this when growth starts to kick in.

But You Definitely Need a Bookkeeping VA if

- Spend more than 1–2 hours/week on books, billing, or categorizing expenses

- Are behind on reconciliations or unclear on what’s actually profitable

- Miss invoices, double-pay vendors, or have no real-time view of cash flow

- Your CPA dreads getting your files

- You’re making growth decisions without reliable numbers

- You’ve tried to hire someone before, but they didn’t know your tools or workflows

- You’re already using QuickBooks, Xero, or payroll software and

If your books are costing you clarity, confidence, or opportunities, it’s time to delegate to remote bookkeepers.

What Virtual Bookkeeper Can Handle?

Invoicing and accounts receivable tracking

Payroll coordination (weekly/bi-weekly/monthly)

Bill payments and vendor communications

Expense categorization and entry

Monthly bank and credit card reconciliations

Financial reporting and cash flow summaries

Working in tools like QuickBooks, Xero, FreshBooks, or Wave

Budget creation and variance analysis

Let´s explore your options:

40 Hours/ Month (Fractional Support)

40 Hours/Month (Fractional Support)

If you:

- Have under 30–50 transactions per month

- Only need monthly reports & reconciliations

- Use QuickBooks or Xero

- Just need reporting + categorization

20 Hours/ Week (Part-Time)

20 Hours/Week (Part-Time)

If you:

- Send regular invoices or receive recurring payments from clients

- Run payroll or pay contractors

- Need weekly reporting, cash flow monitoring, or A/R follow-up

- Use 2–3 tools across finance, billing, and payroll

- Have a team or small staff and need ongoing financial visibility

40 Hours/ Week (Full-Time)

40 Hours/Week (Full-Time)

If you:

- Handle high transaction volume across multiple accounts or departments

- Need full ownership of AP, AR, payroll, and reporting

- Require daily entries, reconciliations, vendor payments, and reporting

- Need a bookkeeper to work closely with your CPA, ops team, or CFO

Not Sure How Much

Bookkeeping Support You Need?

Simpalm Staffing gives you totally fair options to hire virtual bookkeepers.

Why Customers Choose Simpalm?

Full Suite of Virtual Bookkeeper Solutions to Boost Productivity

We’re more than a virtual assistant company that provides bookkeepers; we’re your partner in scaling with structure, trust, and built-in support systems.

Talent Across Latin America

Access a broader pool of professionals, not just one country. We source top-tier VAs across LATAM for diversity and depth.

AI powered Smart Screening

No guesswork in hiring. Our AI-driven platform (Ducknowl) screens for skills, communication, and reliability – so you get the right fit faster.

Fluent, Aligned, Business-Ready

Work with VAs who get your business. English fluency and time zone alignment mean fewer barriers and smoother collaboration.

30 Days Risk Free

No contracts. No upfront fees. With our 30-day fit guarantee, you only move forward if it’s working.

Ongoing Support

Ongoing support is part of the deal. Post-hire check-ins ensure alignment and growth. It’s how we live our value: Be a Sherpa.

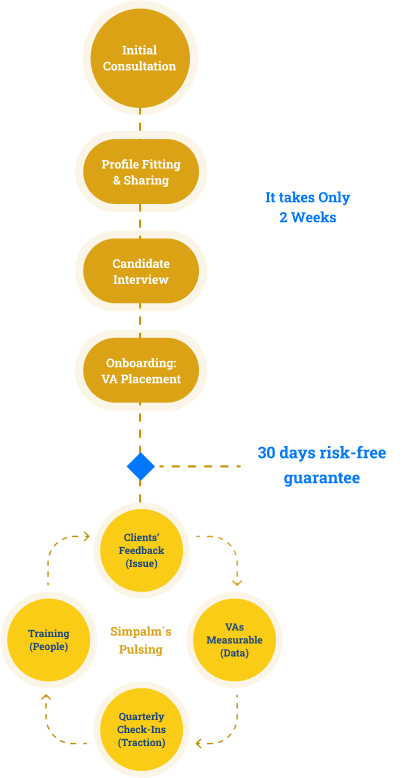

Built for Clarity, Speed, and A+ Hires

Remote Staffing Services with a Process. Not a Pile of Resumes

Guided by Core Values we LIVE and BREATHE… Not just words on a wall – They’re the foundation of how we operate.

Discovery & Role Clarity

We start by understanding your business, pain points, your culture, core values, and hiring goals. We define the role clearly, so we don’t just fill a seat; we fill the right seat.

We listen first, act transparently, and serve as an extension of your team.

Candidate Sourcing Across LATAM

We recruit across multiple Latin American countries, not just one.

This gives you cultural alignment, time zone overlap, and the correct skill set – not just what’s convenient.

We take the harder road so you get the best remote team.

Smart Screening with Our AI Platform

Using Ducknowl, our proprietary hiring tech, we vet candidates with AI skill tests, video interviews, psychometric tests, and scoring, so only the best rise to the top.

We help real talent shine, even if they don’t have a perfect resume.

Final Shortlist & Interview Coordination

You’ll get a curated list of 2–3 top candidates.

Don’t love the shortlist? We’ll send more. There’s no cap on interviews. We handle all scheduling so that you can focus on fit.

We respect your time and every candidate’s dignity.

30-Day Fit Guarantee

You get a whole month to evaluate your new remote staff. If it’s not working, we’ll make it right – fast.

We stand by our placements with integrity and accountability.

Ongoing Alignment & Support

Hiring isn’t the finish line – it’s the starting point.

Our team holds regular check-ins with both you and your new remote hire to ensure ongoing alignment and mutual success.

We walk the journey with you, not just the first mile.

Clients Speak for Simpalm Staffing

Scaling Is Hard — These Founders Got the Right Help

Startups move fast, and so do we. Our remote staffing solutions free up your time, allowing you to focus on growth. Here’s how we’ve helped founders scale smarter.

CTO & DIRECTOR

Our work often deals with clients in very sensitive, emotional situations. The professionalism, empathy, and care their staff show on every call is exactly what we needed.

Founder & CTO

Every time we’ve needed to expand, Simpalm has been able to provide the right person quickly. Whether for client service, bookkeeping, or operations, their talent is vetted, reliable, and adaptable.

CTO & DIRECTOR

WOW! I have interviewed 1/2 dozen firms over the last 3 years that provide staffing through offshore or nearshore resources. I never pulled the trigger until meeting Vikram and his team.

FAQ’s

Everything You Need to Know About Remote Bookkeeper Solutions

We understand our clients and prospects well. Answering some of the most commonly asked questions for our virtual bookkeeper services.

1. What does a bookkeeping VA do?

A bookkeeping VA handles the day-to-day financial tasks that keep your books accurate and up to date—things like invoicing, expense tracking, reconciliations, and reporting. They free up your time while ensuring your financial data is organized and ready when you need it.

2. How is a bookkeeping VA different from an accountant?

A bookkeeping VA focuses on recording and maintaining your financial data, while an accountant interprets that data, offers tax advice, and prepares official filings. Think of your VA as the one who keeps the books clean so your accountant can do their job efficiently.

3. What kinds of tasks can a bookkeeping VA take over?

- Invoicing & Accounts Receivable: Creating, sending, and tracking invoices

- Accounts Payable: Scheduling and processing payments to vendors

- Expense Categorization: Entering and classifying expenses in your accounting software

- Bank & Credit Card Reconciliations: Matching transactions to statements for accuracy

- Financial Reporting: Monthly P&L, cash flow summaries, and balance sheet

4. What industries benefit most from bookkeeping VAs?

Any organization that generates transactions and needs accurate records can benefit from a bookkeeping VA—from small businesses and nonprofits to e-commerce stores, service providers, and real estate agencies. Even solo professionals, like consultants, freelancers, and coaches, gain huge value from having their finances organized and up to date.

5. What software do bookkeeping VAs use?

Common platforms include QuickBooks Online, Xero, FreshBooks, Wave, and Zoho Books. Many also work in Google Sheets, Excel, and project management tools to keep workflows organized.

6. How secure is my financial data?

We prioritize security by limiting your VA’s access to only the tools and information they need. For clients who want an extra layer of protection, we offer a Virtual Desktop option, which keeps all work within a secure, remote environment. Several of our clients choose this solution to streamline setup and maintain a consistent, locked-down workspace for their team members.

7. Can I hire a bookkeeping VA part-time?

Yes. Whether you need just a few hours a week for reconciliations, fractional support for a low number of monthly transactions, or full-time help for high volumes, we tailor the arrangement to your needs.

8. How quickly can a bookkeeping VA get started?

Once access and expectations are set, most bookkeeping VAs can begin within a few days and often have your books organized within the first month.

9. Will a bookkeeping VA help with taxes?

They can prepare your books, so your accountant has clean, accurate data for tax filings—but they don’t replace a CPA for official tax advice or submissions.

10. What if my financial needs grow?

We can scale your bookkeeping VA’s hours or transition you to a more senior resource if your needs expand—without you having to start from scratch.

Still on the Fence? That’s a Sign.

If you’re debating part-time vs. full-time, chances are—you’re already stretched too thin.